Canada’s Stability Pays Off as Global Investment Shifts North

For years, Canada was told it could not survive without the United States. The message was consistent and dismissive: Canada is too small, too dependent, too closely tied to the American economy to ever stand on its own. One trade dispute, one phone call from Washington, and Ottawa would fold.

That assumption is now being tested — and quietly disproven.

As political uncertainty and tariff volatility reshape global supply chains, Canada is emerging as an unexpected winner. Major international manufacturers are redirecting investment north, drawn not by spectacle or threats, but by something far less dramatic: stability.

From Rhetoric to Reality

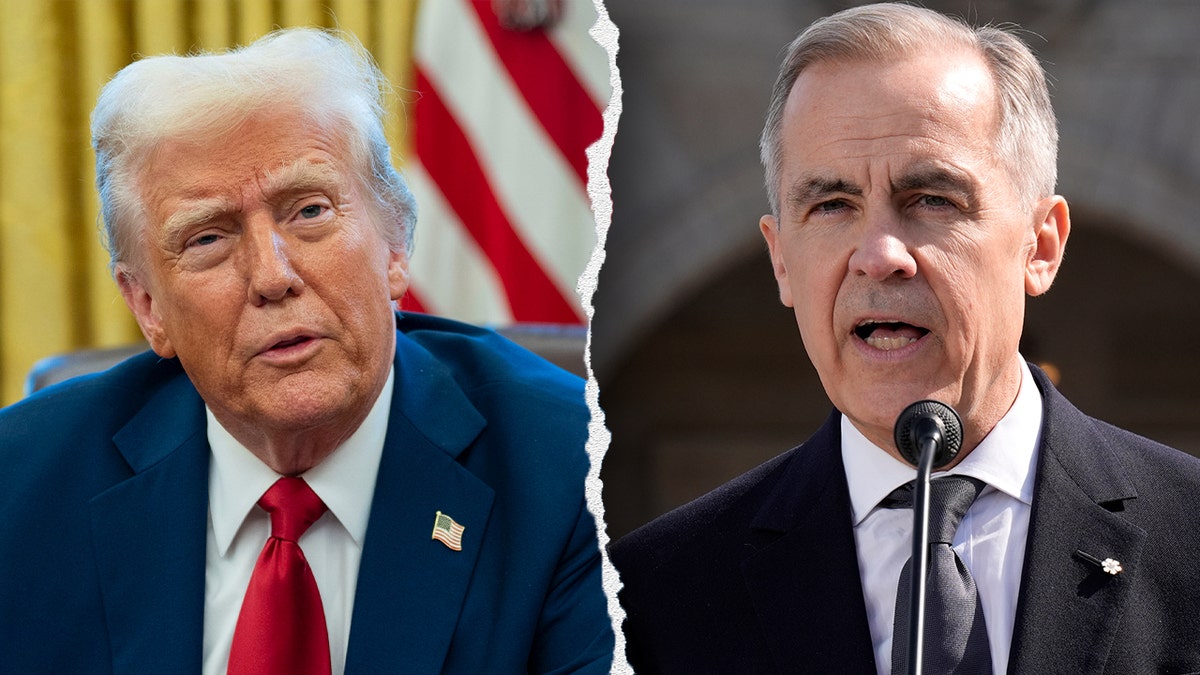

During the past year, former U.S. President Donald Trump escalated trade pressure on Canada through tariffs, public threats, and inflammatory rhetoric. He repeatedly referred to Canada as the “51st state,” questioned the legitimacy of long-standing trade agreements, and floated the idea of withdrawing from USMCA.

Canada did not respond in kind. There were no retaliatory theatrics, no public meltdowns, no dramatic exits from negotiations. Instead, Ottawa stayed predictable, honored agreements, and continued operating through established institutions.

That restraint is now producing measurable economic results.

Volkswagen’s $7 Billion Bet on Canada

The most striking example came in late 2025, when Volkswagen confirmed it would cancel plans for a major U.S. factory while breaking ground on a $7 billion electric vehicle battery plant in St. Thomas, Ontario.

In January 2026, Volkswagen CEO Oliver Blume explained the decision bluntly in an interview with the German newspaper Handelsblatt.

“With unchanged tariff burdens, large additional investment cannot be funded,” Blume said.

The statement was not political. It was financial.

In just nine months of 2025, Volkswagen absorbed $2.5 billion in tariff-related losses — roughly $280 million per month — costs that delivered no productivity gains, no innovation, and no long-term value. In modern automotive manufacturing, where components cross borders multiple times before a vehicle is completed, each tariff compounded the damage.

The math stopped working.

A Broader Collapse in U.S. Investment

Volkswagen’s decision was not an isolated case. According to data from the German Economic Institute, German investment in the United States fell 45% year-over-year in 2025.

Between February and November, German firms invested €10.2 billion in the U.S., down from nearly €19 billion during the same period the previous year. That is not a slowdown. It is a structural retreat.

Critically, those investments did not disappear. They relocated.

Increasingly, they are flowing into Canada.

Why Capital Is Choosing Canada

For global manufacturers, long-term investments are built on 20-year forecasts. Executives model costs, regulatory risks, and supply chain reliability decades in advance.

In the United States, those models have become unstable.

Tariffs change mid-year. Exemptions appear and disappear. Entire trade agreements are threatened. Competitors face different cost structures depending on political favor. Economists refer to this environment as one of “unknowable costs.”

Unknowable costs make long-term investment mathematically impossible to justify.

Canada, by contrast, offers regulatory consistency, honored trade agreements, stable energy pricing, and government incentives that arrive as promised. None of it is exciting. All of it is bankable.

In billion-dollar manufacturing decisions, predictability beats excitement every time.

Building an EV Manufacturing Ecosystem

Volkswagen’s St. Thomas facility will be one of the largest battery cell factories in the world. At full buildout, it will produce 90 gigawatt-hours annually, enough batteries for one million electric vehicles per year.

Construction began in October 2025 on a 350-acre site, involving three massive production facilities, half a million square feet of formwork, and thousands of tons of steel. Production is scheduled to begin in 2027.

But the real story is not one factory. It is an ecosystem.

Between October 2021 and April 2024, automakers announced $46.1 billion in investments across Canada’s EV supply chain, according to Canada’s Parliamentary Budget Officer. Honda, GM, Ford, Stellantis, and Volkswagen have all committed major capital.

Battery plants in Windsor, cathode facilities in Quebec, chemical processors, logistics hubs, and component manufacturers are clustering around these projects. Once built, these ecosystems do not relocate easily.

Jobs, Communities, and Long-Term Impact

Every billion dollars invested in advanced manufacturing produces ripple effects — construction jobs, engineering roles, logistics networks, housing development, and university research partnerships.

These are not temporary positions. They are careers.

While U.S. manufacturing employment has declined by 59,000 jobs since April 2025, many of those jobs are being created in Canadian facilities, paying Canadian wages and contributing to Canadian pension systems.

Economists describe this phenomenon as path dependency. Once an industrial ecosystem takes root, it becomes self-reinforcing. Suppliers move closer. Universities align training programs. Workers relocate permanently. Capital follows proven track records, not future promises.

After years of policy volatility, global firms increasingly classify the United States as a high-risk variable rather than a stable anchor market. Reversing that perception could take decades.

The Strategic Payoff of Restraint

The American approach rested on one assumption: Canada needs the United States more than the United States needs Canada. Tariffs, threats, and insults were designed to force compliance.

Instead, they produced diversification.

Each threat strengthened political support in Canada for investing in alternatives. Each bout of uncertainty reinforced Canada’s reputation as the reliable option. Ottawa did not panic. It kept building.

The factories rising today in St. Thomas, Windsor, and Quebec will outlast current political cycles. Long after trade rhetoric fades, those facilities will still be producing, employing, and generating wealth.

A Quiet Turning Point

This is not a political victory. It is an economic foundation.

Canada did not win by shouting louder or escalating conflict. It won by doing what it has always done: honoring agreements, maintaining institutions, and staying boring.

In a world increasingly defined by volatility, those boring virtues are worth more than $20 billion — and counting.

The assumption that Canada could not survive without American approval is being rewritten, not by speeches, but by cranes, concrete, and long-term capital.

The world did not need chaos. It needed stability.

And it found it north of the border.