1 MIN AGO: CANADA SLAMS U.S. WITH RECORD LUMBER TARIFFS — AMERICAN HOUSING MARKET HITS BREAKING POINT

Canada has just delivered the hardest blow in the history of the U.S.–Canada lumber dispute, with combined American tariffs on Canadian softwood lumber surging past 45%, the highest level ever recorded. The fallout is immediate and severe. U.S. homebuilders are facing soaring material costs, stalled projects, and collapsing confidence, while Canada quietly pivots away from the American market altogether. What was framed in Washington as a pressure tactic is rapidly turning into a full-scale housing affordability crisis for American families.

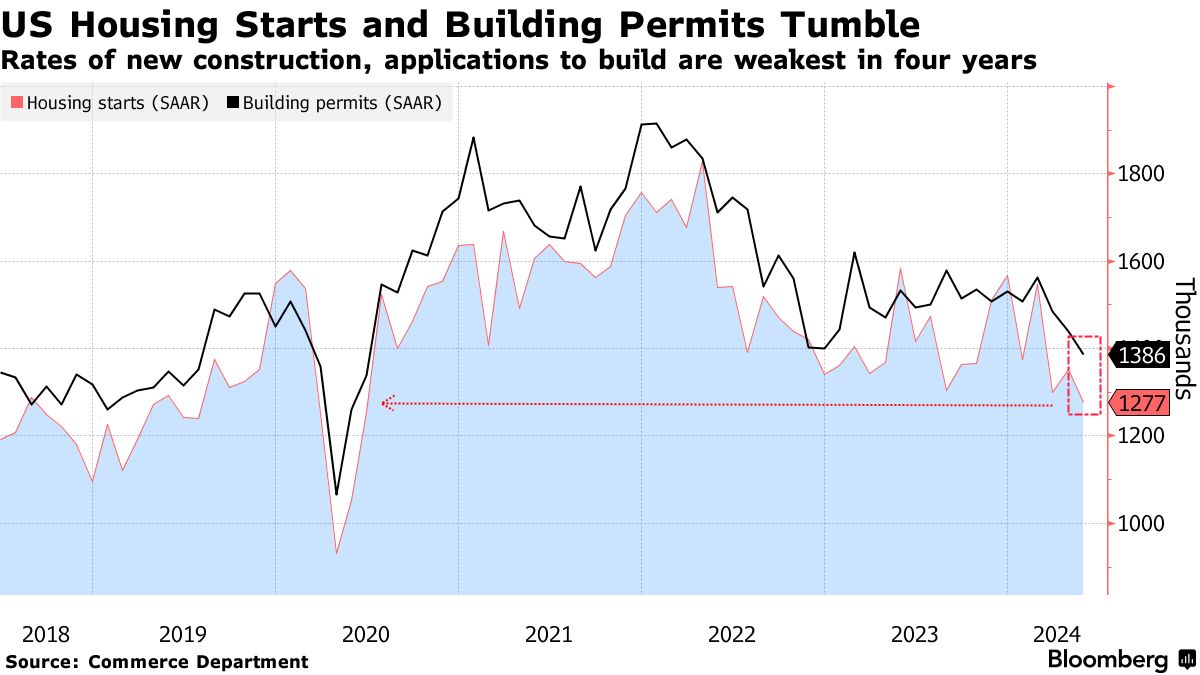

According to the National Association of Home Builders, two-thirds of builders are now offering incentives just to close sales, as housing starts slide and projects are delayed or canceled outright. Builders estimate that tariffs are adding nearly $11,000 to the cost of a typical new home, driven by higher lumber prices and cascading increases in cabinets, furniture, and interior materials. With mortgage rates already elevated and inventory critically low, the tariffs are amplifying an affordability crunch that was already near historic extremes.

The tariff shock did not appear overnight. Longstanding anti-dumping and countervailing duties were first raised sharply in 2025, before the Trump administration escalated further using Section 232 national security powers—an extraordinary move critics say stretched the definition of “security” beyond credibility. The result is a market distortion the United States is ill-equipped to absorb. Canada supplies roughly 30% of total U.S. lumber consumption, and American sawmills simply lack the processing capacity to replace that supply in the short or even medium term.

While U.S. builders struggle, Canada is executing a calculated exit strategy. Ottawa has rolled out $2.35 billion in federal support to keep mills operating, expand domestic wood use, and aggressively develop new export markets. Asia has emerged as the primary destination, with China, Japan, South Korea, and India absorbing volumes that once flowed south. Canadian producers are accepting lower prices today to lock in long-term relationships that reduce dependence on an increasingly unpredictable American market.

The irony is that the tariffs have achieved none of their stated goals. American mill capacity is not expanding fast enough, construction employment is weakening, and housing supply is shrinking further. The primary beneficiaries are a small group of domestic producers represented by the U.S. Lumber Coalition, while the broader economy absorbs the damage. As Canada invests in Pacific-facing infrastructure, value-added wood products, and mass timber construction at home, each month of elevated tariffs makes the shift away from the U.S. more permanent.

The long-term risk for the United States is no longer higher prices alone—it is the loss of Canadian supply altogether. Once mills retool for Asian specifications and logistics chains bypass U.S. ports, Washington’s leverage disappears. What began as a trade weapon under Donald Trump is now accelerating a structural realignment of global lumber trade. Canada is building a future where American negotiations matter less, while U.S. homebuyers are left paying the price—one increasingly unaffordable home at a time.