CARNEY ERUPTS: TRUMP FROZEN IN SHOCK as $780 BILLION Trade Routes IMPLODE Overnight — Canada Strikes BACK with DEVASTATING Threat! 🇨🇦💥🇺🇸

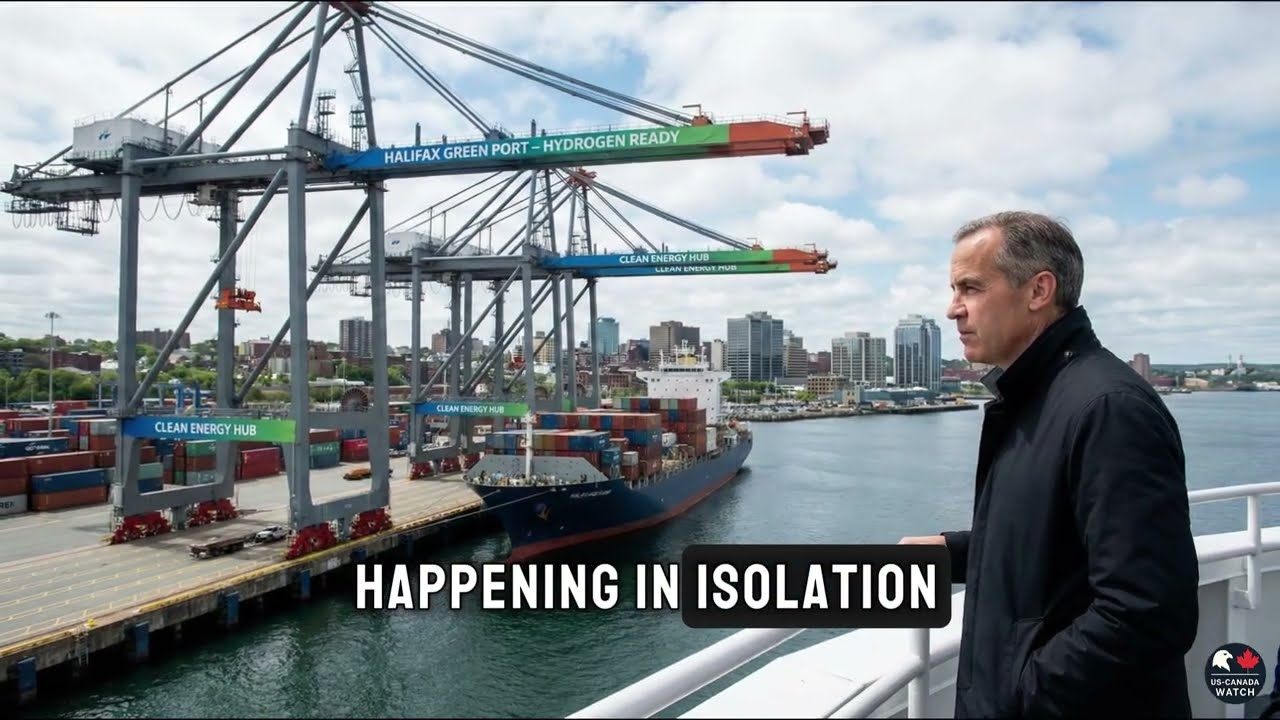

In a stunning economic meltdown that has reverberated across North American trade corridors, Canadian Prime Minister Mark Carney has orchestrated a masterstroke of strategic foresight, unleashing a modest yet devastating $25 million investment in the Port of Halifax that threatens to permanently erode United States dominance over transatlantic shipping. What began as a routine federal announcement by Transport Minister Anita Anand in early 2025 has exploded into a full-blown crisis for American ports, as Halifax surges ahead to become the continent’s first operational hydrogen refueling hub—positioning Canada to capture billions in rerouted cargo flows while U.S. facilities remain mired in endless bureaucratic paralysis.

The Halifax-Hamburg Green Shipping Corridor, bolstered by up to $22.5 million from Canada’s Green Shipping Corridor Program, is no mere environmental gesture. Construction has already commenced on a hydrogen production facility powered by Nova Scotia’s hydroelectric resources, bunkering equipment for rapid refueling of alternative fuel vessels, electrification of port operations, and the acquisition of an electric rail locomotive to shift freight from diesel trucks to zero-emission rail. This integrated system promises carbon-neutral transatlantic passages, perfectly timed to meet the European Union’s mandatory carbon reporting requirements taking effect in 2026. European shipping giants—facing escalating penalties for high-emission routes—are suddenly confronted with a stark choice: endure costly compliance hurdles through conventional U.S. ports or pivot to Halifax, where green infrastructure delivers immediate advantages in cost, reliability, and emissions compliance.

For the United States, the fallout has been catastrophic and swift. Major East Coast gateways like New York-New Jersey, Virginia, Charleston, and Savannah—handling tens of millions of containers annually—boast no comparable hydrogen infrastructure, no refueling capabilities for emerging zero-emission vessels, and no firm construction timelines. Regulatory hurdles in the U.S., including protracted environmental impact assessments, federal safety certifications, and multi-jurisdictional coordination, have stalled progress for years. While American port authorities issue press releases touting sustainability goals, Halifax has broken ground and races toward operational status by late 2026 or early 2027. This first-mover advantage is proving irreversible: once major lines like Hapag-Lloyd, Maersk, and CMA CGM establish Hamburg-Halifax routes, optimize logistics networks, and integrate inland electric rail connections reaching deep into the Midwest, switching back becomes logistically and economically prohibitive.

The narrative of American decline intensifies when viewed against the backdrop of political instability. President Donald Trump’s aggressive tariff threats and erratic trade policies have injected chronic uncertainty into North American supply chains. European manufacturers and shippers, reliant on predictable routes for automotive parts, machinery, and chemicals flowing from Hamburg, increasingly view U.S. ports as risky propositions—vulnerable to sudden levies, retaliatory measures, or diplomatic escalations. Halifax, by contrast, offers stability: a predictable regulatory environment, no arbitrary tariff volatility, and now a green gateway that aligns seamlessly with EU mandates. Cargo that once funneled through New York or Virginia is quietly diverting northward, accelerating a permanent loss of market share and the associated jobs that sustain hundreds of thousands of American workers in port-related industries.

Compounding the humiliation, Halifax’s investment extends beyond ships to address longstanding geographic disadvantages. Electric rail incentives and CN Railway integration create end-to-end carbon-neutral delivery from Hamburg to Chicago or Toronto—outpacing U.S. diesel-dependent rail networks that expose shippers to future carbon penalties. As European regulations tighten annually, the cost gap widens inexorably in Canada’s favor. This is not incremental competition; it is a structural realignment of global trade flows, where a nimble $25 million Canadian initiative exploits American gridlock to seize dominance in the fastest-growing segment of transatlantic commerce.

Prime Minister Carney’s broader vision—diversifying away from U.S.-centric dependencies through projects like Trans Mountain redirects, Arctic route development, and enhanced Atlantic gateways—has found its sharpest expression in Halifax. While U.S. ports grapple with aging infrastructure, labor disputes, and political fragmentation that delays even basic upgrades, Canada executes with precision and speed. The result is a profound shift: European lines prioritizing Halifax for green vessels, inland distribution centers relocating to optimize Canadian entry points, and U.S. exporters facing mounting isolation in a decarbonizing world.

This crisis underscores a harsh reality for American maritime policy: hesitation in embracing green infrastructure amid regulatory complexity and competing priorities has handed Canada an unassailable edge. As trade routes valued in the hundreds of billions realign overnight, the Port of Halifax stands poised to lock in gains that could endure for decades, leaving U.S. East Coast hubs to confront a future of diminished relevance and economic erosion. The $25 million bet has paid off spectacularly, transforming a quiet Atlantic outpost into the decisive pivot point in North American trade dominance.